"Consumers Not Following Orders

Jun 15, 2015

by: James_Quinn

Last week the government reported personal income and spending for April. After months of blaming non-existent consumer spending on cold weather, shockingly occurring during the Winter, the captured mainstream media pundits, Ivy League educated Wall Street economist lackeys, and Keynesian loving money printers at the Fed have run out of propaganda to explain why Americans are not spending money they don’t have. The corporate mainstream media is now visibly angry with the American people for not doing what the Ivy League propagated Keynesian academic models say they should be doing.

The ultimate mouthpiece for the banking cabal, Jon Hilsenrath, who does the bidding of the Federal Reserve at the Rupert Murdoch owned Wall Street Journal, wrote an arrogant, condescending, putrid diatribe, directed at the middle class victims of Wall Street banker criminality and Federal Reserve acquiescence to the vested corporate interests that run this country. Here are the more disgusting portions of his denunciation of the formerly middle class working people of America.

We know you experienced a terrible shock when Lehman Brothers collapsed in 2008 and your employer responded by firing you.

We also know you shouldn’t have taken

out that large second mortgage during the housing boom to fix up your

kitchen with granite counter-tops.

You should feel lucky you’re not a Greek consumer.

Fed officials want to start raising

the cost of your borrowing because they worry they’ve been giving you a

free ride for too long with zero interest rates.

We listen to Fed officials all of the time here at The Wall Street Journal, and they just can’t figure you out.

Please let us know the problem.

The Wall Street Journal was swamped with thousands of angry responses from irate real people living in the real world, not the elite, QE enriched, oligarchs living in Manhattan penthouses, mansions on the Hamptons, or luxury condos in Washington, D.C. Hilsenrath presumes to know how the average American has been impacted by the criminal actions of sycophantic Ivy League educated central bankers and their avaricious Wall Street owners.

He thinks millions of Americans losing their jobs and their homes due to the largest control fraud in financial history is fodder for a tongue in cheek harangue, blaming the victims for the crime. Hilsenrath reveals he is nothing but a Fed flunky who is fed whatever message they want the plebs to hear. His job is to obscure, obfuscate, spread disinformation, and launch Fed trial balloons to see whether the ignorant masses are still asleep. The Fed and their owners can’t understand why their propaganda hasn’t convinced the peasantry to follow orders.

A system built upon an exponential increase in debt, cannot be sustained if the masses stop buying Range Rovers, McMansions, stainless steel appliances, 72 inch HDTVs, iGadgets, bling, and boob jobs on credit. His letter to America reeks of desperation. The Fed and their minions have used every play in their Keynesian monetary playbook, and are losing the game in a blowout. With a deflationary depression beginning to accelerate, they have no game.

Despairing mothers, unemployed fathers, impoverished grandmothers, and indebted young people are supposed to feel lucky because they aren’t starving to death like the wretched Greeks. We do have one thing in common with the Greeks. We’ve both been screwed over by bankers and corrupt politicians. Did you know you’ve been given a free ride by your friends at the Federal Reserve? Did you know that zero interest rates and $3.5 trillion of Quantitative Easing (aka money printing) were implemented to benefit you? According to Hilsenrath, the Fed lending money at 0.25% to their Wall Street bank owners, who then allow you to borrow from them at 15% on your credit card, represents a free ride for you. Are the subprime auto loan borrowers, who account for 30% of all auto sales, paying 13% interest getting a free ride?

Hilsenrath is purposefully lying. Bernanke and Yellen have been saying they want to start raising interest rates for the last four years. Remember the 6.5% unemployment rate bogey set by Bernanke in January 2013? Unemployment dropped below 6.5% in early 2014 on its way to 5.5% today. Did they raise rates? In 2013 we had two consecutive quarters of 4% GDP growth, with no Fed rate increase. In 2014 we had two consecutive quarters of 4.8% GDP growth, with no Fed rate increase. We have added ten million jobs and the stock market has tripled since 2009, with no Fed rate increase.

We are supposedly in the sixth year of an economic recovery and the Fed is still keeping the discount rate at a Lehman “world is ending” emergency level of .25%. Six years after the last recession the discount rate was 5.25%. The last time the unemployment rate was this low the discount rate was 4%. The only ones getting a free ride from the Fed’s zero interest rate policy and QE to infinity have been Wall Street banks, the .1% who live off the carcasses of the dying middle class, zombie corporations who should have gone bankrupt, and politicians who keep running up the national debt with no consequences – YET. The Federal Reserve is a blood sucking leech on the ass of America. Their cure has been far worse than the original illness – Wall Street criminality. In fact, their cure has been to reward the Wall Street criminals while spreading cancer to the working class and euthanizing senior citizens.

Hisenrath and his puppet masters at the Fed can’t figure you out. For decades you have followed their orders and bought Chinese produced shit with one of your 13 credit cards. The Bernays’ propaganda playbook has produced wins for the ruling class since the early 1980’s. Their record is 864 – 0 versus the working class. Our entire warped economic system since the 1980’s has been dependent upon an exponential increase in debt peddled by Wall Street to citizens, government and corporations to give the appearance of a growing, healthy economy.

An economy built upon the consumption of iGadgets, Cheetos, meat lovers stuffed crust pizza, and slave labor produced Chinese baubles, along with the production of enough arms to blow up the world ten times over, and the doling out of trillions to the non-productive class, is doomed to fail. Maybe I can explain the situation in such a way that even an Ivy League educated central banker or a Wall Street Journal faux journalist will understand.

Maybe Jon and his Fed cronies could be enlightened by a look at the American consumer before the bubble boys (Greenspan, Bernanke) and gals (Yellen) at the Fed, along with the corporate fascist takeover of our political system, and the propaganda spewing corporate media monopolies, combined to deform our financial and economic system for their sole enrichment. The lack of spending by consumers might just be due to some of the following factors:

- Back in 1980 income meant money earned through working, investing, and saving. The amount of personal income made up of wages totaled 60% in 1980. Today it totals 51%. Interest earned on savings accounted for 14% in 1980. Today it accounts for 8%, as the Fed has punished seniors and savers with negative real interest rates. Since 2009 the Fed has robbed over $1 trillion in interest income from seniors and savers with their zero interest rate policy and handed it to the Wall Street banking cabal. Bernanke didn’t just throw seniors under the bus, he ran them over, backed up over them, and ran them over again.

- In a shocking development, government welfare transfers accounted for 11% of total personal income in 1980 and have risen to 17% today. Only the government could classify money which has been absconded at gunpoint from working Americans in the form of taxes and redistributed back to other Americans as welfare payments, as personal income. If you take money from your left pocket and put it in your right pocket, is that income? The replacement of wages and interest by welfare redistribution payments has not benefited society whatsoever.

- In 1980 consumer credit outstanding as a percentage of personal income totaled 15%. Today it totals 22%, an all-time high. It is higher than the bubble peak in 2007-2008. Real per capita disposable income has only risen by 88% over the last 35 years. Meanwhile, real per capita consumer debt has risen by 288%. Wages and earnings from saving have been replaced by debt. The propagandists for consumerism have convinced the ignorant masses to spend money they don’t have, while pretending to be wealthier and successful. Consumer debt currently stands at a towering all-time high of $3.4 trillion, almost ten times the $350 billion level in 1980. Hilsenrath and the Fed are upset with you because credit card debt still lingers $122 billion, or 12% below 2008 levels. It has forced them to dole out $900 billion of government controlled subprime debt to University of Phoenix wannabes and any deadbeat that can scratch an X on an auto loan application. The U.S. economic system is like a Great White Shark that must keep swimming or it will die. The Federal Reserve run U.S. economic system must keep generating debt or it will die. They are growing desperate and you are not following orders.

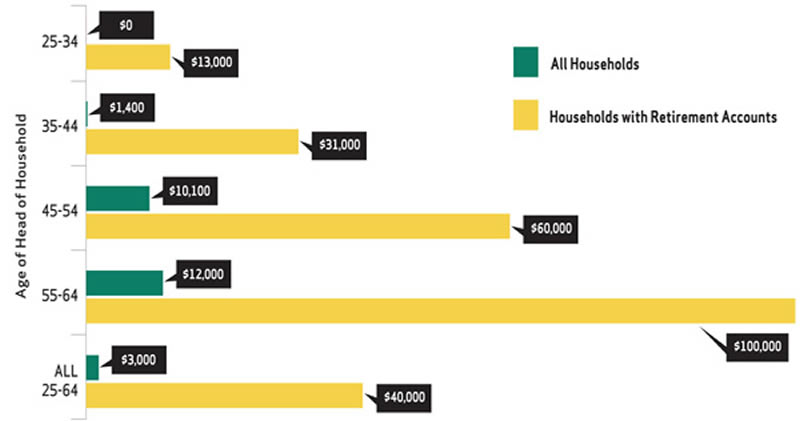

- Before the grand debt delusion overtook the populace, they were saving 11% of their disposable personal income. In 1980, Depression era adults still believed in saving for large purchases such as a house, car, appliance or home improvement. The young adult Boomers didn’t have the same experiential deterrent. They were convinced by the Wall Street debt peddlers, Madison Avenue maggots, and corrupt politicians that saving was for suckers. Live for today, for tomorrow may never come. Well tomorrow did come. Boomers are entering their retirement years with $12,000 in retirement savings, while still in debt up to their eyeballs. There have been 10,000 Boomers turning 65 every day since 2010. This will continue unabated through 2029. This demographic certainty was already depressing consumer spending, as this age demographic spends far less than 25 to 54 year olds. Factor in the pitiful amount of savings and you have an ongoing spending implosion.

- The propaganda machine was so well oiled, the savings rate actually reached 1.9% in 2005, as the masses all believed they would live luxurious retirements off their home equity windfall. How’d that delusion work out? The current level of 5.6% is seen as troublesome by the powers that be. They cannot accept the crazy concept of saving and investment when their entire warped paradigm is built upon borrowing and consumption. Banks don’t make money when you save and they despise when you use cash. They can’t sustain their opulent lifestyles without their 3% VIG on every electronic transaction, 15% compounded interest on the $5,000 average credit card balance, billions in late fees for being one day late with your payment, $4 on every ATM transaction, and the myriad of other fees and surcharges designed to bilk you and keep you from saving. The saving rate will continue to climb as people have no choice to make up for years of living beyond their means.

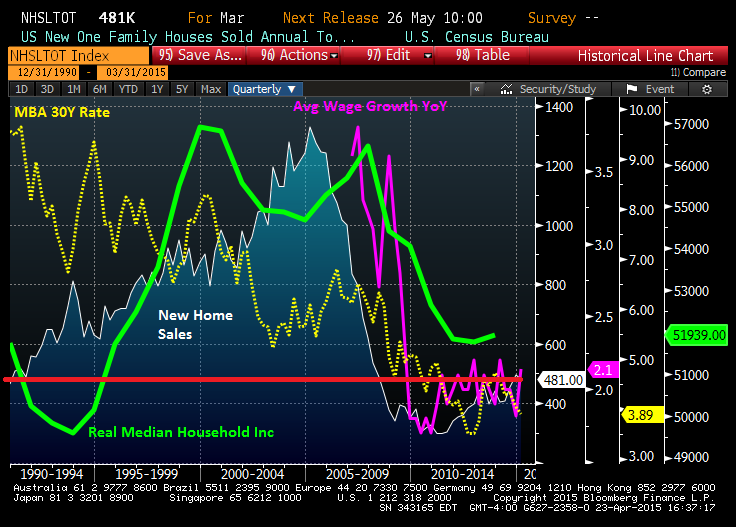

- Hilsenrath is willfully ignorant as he pretends to not understand why the American people will not or cannot accelerate their spending. It is really quite simple. Even a PhD should be able to understand. Real median household income was $52,300 in 1989. Real median household income today is $51,939. The median household has made no economic advancement in the last quarter of a century. And this is using the manipulated lower CPI figure. Using a true inflation rate would show a dramatic decline over the last 25 years. There has been virtually no wage growth during this supposed six year recovery. The industrial base of the country has been gutted, except for the production of arms to blow up brown people in the Middle East. Young people have $1.3 trillion of student loan debt weighing them like an anchor, and those Ruby Tuesday waitress jobs and Home Depot cashier jobs aren’t going to cut it.

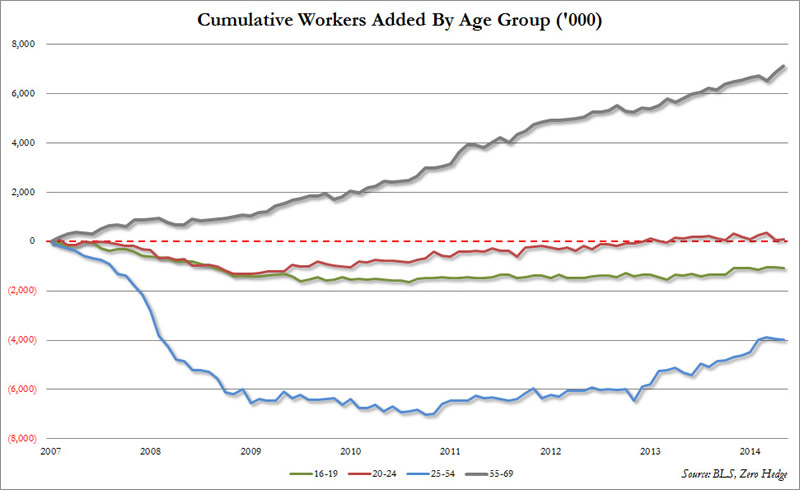

- So we have the demographic dilemma of aging, under-saved, over-indebted Boomers who are being forced to spend less. We have an over-indebted, under-employed youth who don’t have anything to spend. And lastly we have the 25 to 54 year old age bracket who should be in their prime earning and spending years who are still 4 million jobs short of where they were in 2007 before the Fed induced financial collapse. The only age bracket to gain jobs since the crisis has been 55 to 69, as they have been forced to work to make up for their lost interest income. The only people making job gains are those least likely to spend.

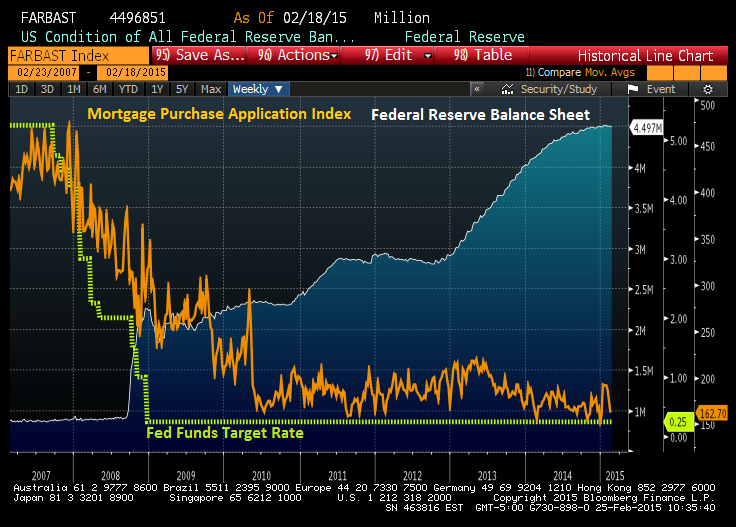

- The spending crescendo in 2004 through 2007 was fueled by the Greenspan housing bubble and the $3 trillion of mortgage equity withdrawal used to buy BMWs, in-ground Olympic size pools, Jacuzzis, vacations to Tahiti, home theaters, granite countertops, stainless steel appliances, and boob jobs, by delusional, apparently brain dead Americans who fell for the Bernaysian propaganda spewed by the Wall Street criminal class, hook line and sinker. The majority of shell shocked underwater home owners have been unable to sell since the housing crash. A 35% price decline will do that. The Fed has created $3.5 trillion out of thin air, more than quadrupled their balance sheet with toxic mortgages from Wall Street, artificially suppressed interest rates to bring mortgage rates to record lows, and was a co-conspirator along with Fannie, Freddie, FHA, and Wall Street hedge funds (Blackrock) to delay foreclosure sales and pump home prices with their buy and rent scheme. The result has been unaffordably high prices, mortgage applications at 1997 levels (60% below 2005 levels), first time buyers at a record low, and a non-existent housing recovery – despite the MSM propaganda saying otherwise.

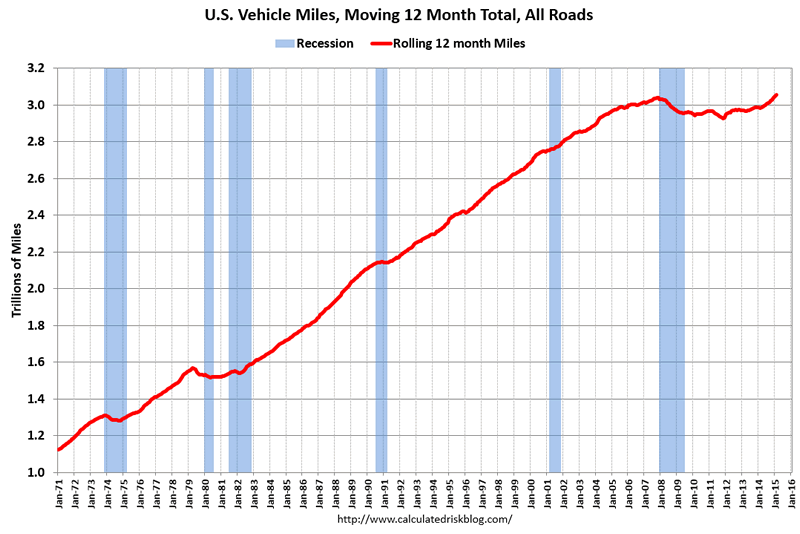

- The last data point which might help the math challenged Hilsenrath understand why you aren’t spending is total U.S. vehicle miles driven. The chart below shows a relentless climb from 1982 through to the 2008 collapse. It coincides with the debt fueled consumption orgy over this same time frame. The unrelenting expansion of retail outlets and importing of cheap Chinese crap required a lot of trucks to haul the crap. It required a lot of trips to the mall in the minivans and SUVs by soccer moms living in our suburban sprawl paradise. In case you hadn’t noticed, the fastest growing retailer in the U.S. since 2008 has been Space Available. The well run retailers like Home Depot and Wal-Mart saw the writing on the wall and stopped expanding. The badly run retailers like Sears and JC Penney have been closing hundreds of stores. And the really badly run retailers like Radio Shack have gone bankrupt. Vehicle miles have essentially flat-lined for the last six years as retailers are closing more stores than they are opening, job growth has been non-existent and commerce within the U.S. is stagnant. If we were experiencing a real economic recovery, vehicle miles would be surging.

So this concludes my little tutorial for the Ivy League educated central bankers at the Fed and the Wall Street Journal Fed mouthpiece – Jon “I don’t understand” Hilsenrath. I know it is difficult for people to understand something when their paycheck depends upon them not understanding it, but this is pretty simple stuff. Pompous, arrogant, egocentric assholes who write for the Wall Street Journal, run JP Morgan, or control monetary policy for the world, know exactly what they have done, what they are doing, and who is benefiting. We all know the benefits of ZIRP and QE have gone only to the .1% who run the show. We know income inequality is at all-time highs. We know TPP will be passed, because the corporate fascists control the purse strings of our political class. We know the status quo will be maintained at all costs by the Deep State.

We know mega-corporations continue to ship jobs overseas and replace us with cheap foreign labor. We know the current administration actively encourages illegals to pour over our borders, swamp our social safety net, increase crime, and take jobs from Americans. We know the government has us under mass surveillance and will not hesitate to use all of that military equipment in the hands of local police against us. The will of the people is nothing but an irritant to those in power. They might not have us figured out, but a growing number of critical thinking, increasingly pissed off people, have them figured out. The debt expansion days are numbered. A deflationary depression is in the offing. The coming civil strife, financial panic, war, and overthrow of the existing social order will rival the three previous tumultuous upheavals in U.S. history – American Revolution, Civil War, Great Depression/World War II. Fourth Turnings are a *****.

Hopefully I’ve explained the situation to the satisfaction of Jon and Janet. The mood in this country is darkening by the day. There is no going back to the good old days of yesteryear. They are long gone. No amount of debt issuance and propaganda is going to work. The system is overloaded. The people are angry. The politicians are captured. The banking elite are ransacking the nation for every last dime they can get their grubby little hands on. The military industrial complex is itching for war with Russia and China. The world hates us. If you can’t see it coming, you are either blind, dumb, or an Ivy League educated economist. So go out and spend to make your slave owners happy.

--MORE--"

Now for the garbage:

$$DD

Consider this the $$DM version:

"US adds 280,000 jobs in May" By Megan Woolhouse Globe Staff June 05, 2015

The economy is showing signs of heating up again after a brutal winter in many parts of the United States brought growth to a standstill in the first quarter.

It was actually a contraction, but....

Combined payroll gains were revised upward for the previous two months.....

PFFFFT!

“Job growth roared back to life in May,” said Scott Anderson, chief economist at Bank of the West in San Francisco.

The economy shrank 0.7 percent annual rate in the first three months of the year, a drop economists blamed on the impact of unusually cold weather, work slowdowns at some US ports, and falling energy prices.

I love how the earth is warming until it comes time to explain the $hit economy.

Economists said the latest payroll numbers, which exceeded their forecasts, indicate that the slowdown was temporary and the US expansion is back on track....

The inspiration for the title of this post.

The unemployment rate, which is calculated from a separate survey of households, rose to 5.5 percent, from 5.4 percent in April, but the increase was largely due to more Americans resuming job searches, a sign they are more confident in their prospects.

I'm so, so tired of $hoveled $hit narratives.

The official unemployment rate does not include people who don’t actively look for work.

We will get to the REAL UNEMPLOYMENT RATE further down.

The Massachusetts unemployment rate was 4.7 percent in April. The state releases unemployment statistics for May in about two weeks.

Will get to the state, too.

Jim O’Sullivan, chief US economist at High Frequency Economics, a forecasting firm in Valhalla, N.Y., described May’s job growth as “strong.” He said the nation is approaching “full employment,” a condition in which almost everyone who wants a job can get one and generally considered by economists as a jobless rate between 5 and 5.5 percent.

It used to be considered 3% forty years ago, and what kind of Orwellian $y$tem considers any unemployment at all full employment?

I'm really, really tired of the bu$ine$$ pre$$ condescension and insults.

“Employment growth is more than strong enough to keep the unemployment rate coming down,” O’Sullivan said.

Job growth was broad-based last month spread across nearly all the major sectors tracked by the Labor Department.

Sectors that play key roles in the Massachusetts economy, such as health care and professional and technical services, posted sold gains nationally.

For some pockets of the economy, however, problems remain.

What?

Nearly half of the growth in jobs was in low-wage sectors, such as retail, leisure and hospitality, and temporary help services. The unemployment rate for 18- to 29-year-olds, is about 9.1 percent, according Generation Opportunity, a Washington nonprofit that advocates for young Americans.

That's strange, because I was told millennials are doing great!

A broader measure of unemployment that includes workers who have given up job searches and those employed part-time because they can’t find full-time jobs was nearly 11 percent in May.

The real rate is something like 38% when counting all!

In a recent speech in Connecticut, Eric Rosengren, president of the Federal Reserve Bank of Boston, cited these workers as evidence that the labor market, while improved, is weaker than the official unemployment rate would suggest.

Related:

"Eric S. Rosengren (right), president of the Federal Reserve Bank of Boston, said Monday that policy makers should wait until the economy strengthens further before raising short-term interest rates. Rosengren, speaking in Hartford to a workforce development group, said the economy, which contracted in the first quarter, has been weaker than expected for several months and forecasts of stronger growth have proved too optimistic. While a severe winter contributed to some of the weakness, it does not account for all of it, he said. “The conditions for the tightening of monetary policy have not yet been met,” he said. Tightening is the term for raising interest rates.... Consumer spending was the weakest in three months in April, but a solid gain in income growth should help boost spending, which was flat after a revised 0.5 percent increase in March, the Commerce Department reported. April’s reading had been expected to be lackluster, given the weaknesses previously reported in retail and auto sales for the month. Economists, however, forecast that spending will rebound in coming months amid strong gains in employment."

Not being too optimi$tic there?

He called on Fed policy makers to be patient and wait for the economy to gain more strength before raising rates.

Since the end of the winter, the economy has grown moderately, according to a recent Fed survey. Despite steady job gains, consumer spending which accounts for more than two-thirds of US economic activity, has been lackluster, economists said. A strong dollar is hurting the nation’s exports, since foreign buyers must now to pay more for American goods.

Imports cheaper then, right?

Not, and no spending power either!

Brian Bethune, an economics fellow and professor at Tufts University, predicted that the Fed will wait until November or December to move on rates. Policy makers, he said, are “going to have to backpedal on recent communications about the likelihood of a rate hike in the near future.”

And I predict the Patriots will win the AFC East again this year. How much that crap pile worth?

Yup, these propaganda pushers been wrong, wrong, wrong, but believe in the whoreporate pre$$ experts.

--more--"

Related:

"Stocks rose for a second day after an encouraging report on retail sales suggested that Americans are finally feeling confident enough to spend more. Investors have worried that corporate profits would stall if the US economy, and the consumers who drive much of its growth, didn’t show more vigor. The retail report for May helped ease those concerns, for the moment at least."

First of all, we have no money. It's all been sucked upward.

Secondly, what is with the endle$$ $tream of mixed me$$ages.

"The deal is the latest in an industry that is looking to acquisitions to boost lackluster sales and cut costs. Sales are falling for personal computers because people are increasingly turning to smartphones and tablets. The recent wave of deals in the chip industry could have a downside for consumers, said Tony Cherin, a finance professor emeritus at San Diego State University. As the big players buy up smaller companies, he warned, there is a danger that competition will diminish and consumers could see higher prices for electronics products. Intel, based in Santa Clara, Calif., is the world’s largest maker of PC chips and dominates the market for chips used in servers, a much more profitable product."

That is an industry that is supposed to be carrying the whole thing, and we have seen this before. Read your history books, late 19th century America.

Now about this software chips....

"Officials have said that they are eager to begin the slow journey back toward normalcy. But growth continues to disappoint their expectations. The economy shrank at an annual rate of 0.7 percent in the first quarter, according to the latest government estimate. Job growth has weakened. The IMF said that the strength of the dollar, caused partly because of weakness in the rest of the developed world, was hampering domestic growth and that things could get worse."

Say what?

"World economy heals slowly; Group predicts healthier growth by end of 2016" by David Jolly New York Times June 04, 2015

PARIS — The world economy continues to heal at a disappointingly slow pace, the Organization for Economic Cooperation and Development said Wednesday, but it predicted growth would return to a healthier rate by the end of 2016.

Actually, a few have done very well, but this is getting old and you kids will be falling into an even-wider Gap.

“Global growth is improving, but it’s not good enough,” Catherine L. Mann, the organization’s chief economist, said in a conference call held before the release of the forecast by the OECD, the research and policy organization of the world’s richest countries. “It’s a B-minus performance.”

The slow growth, Mann said, has contributed to weak labor markets and rising inequality in many countries.

With energy prices relatively low and monetary policy accommodative, growth next year should reach 3.8 percent, she said. That would be the strongest level since before the 2008 credit crisis, Mann noted, though she expressed concern about the weak start to 2015 and the continued poor investment climate.

Mann said she expected global fixed investment, “a key component of potential output,” to rise by about 4 percent next year, the highest since the financial crisis started in 2008. Even that would fall short of the amount needed to return labor markets to normal and raise living standards for those who have missed out on the recovery, she said.

In other words, there never was a recovery for the vast majority of citizens of planet Earth.

She cited several risks, however, to that relatively optimistic picture.

Here we go again!

Among them are the Greek economic and fiscal crisis, which remains unresolved; the possibility of a sharp slowdown in China; and the danger that financial markets will slump when the Federal Reserve begins raising interest rates.

Well, Greece no longer a problem and China has righted the $hip.

The United States, which lost ground in the first quarter by one key measure — changes in gross domestic product — is expected to eke out an advance of about 2 percent for the year as a whole, accelerating to 2.8 percent next year, according to the OECD forecast.

“US growth projections remain weak compared with recoveries we’ve seen in the past,” she said. The group projected that the Federal Reserve would raise interest rates to 2 percent by December 2016, from a current level near zero.

Despite its relatively meager outlook, the US economy, by most measures, continues to outperform nearly all other advanced industrial nations....

Yup!

--more--"

"Fed stands pat on stimulus effort, may slow rate increases" by Binyamin Appelbaum New York Times June 17, 2015

WASHINGTON — Federal Reserve officials expect to raise interest rates more slowly than they had previously predicted, with a growing number favoring only a single increase this year in the Fed’s benchmark rate.

As expected, the Fed on Wednesday announced no changes in its stimulus campaign, following a meeting of its policy making committee. But economic forecasts the Fed published separately showed that officials are once again leaning toward keeping interest rates lower for longer.

Fed officials reduced their forecasts for growth during the current year, a retreat that has become a ritual for the perpetually optimistic central bank. Officials now expect growth between 1.8 percent and 2 percent this year. Just a few months ago, in March, they had predicted growth between 2.3 percent and 2.7 percent.

Listen to 'em!

Why should we believe a GODDAMN WORD!!!!!!!!!!!!???

The Fed said in its statement that the economy has resumed a moderate pace of expansion after another disappointing winter.

Fed officials retained a more upbeat view about coming years, at least for the time being.

Question: do they ever smell the $hit they are shoveling?

This year, however, officials predicted the unemployment rate would fall more slowly.

The economy shrank at an annual rate of 0.7 percent in the first quarter, and forecasters have reduced their expectations for the rest of the year.

Job growth, however, has remained relatively strong....

Depending on how you count it.

--more--"

Related:

"Consumer prices increased in May by the largest amount in more than two years, reflecting the biggest one-month jump in gasoline prices in nearly six years. But apart from the energy market, price pressures remained modest. The consumer price index rose 0.4 percent, the Labor Department reported Thursday. The increase was driven by a 10.4 percent rise in the cost of gasoline, which has started climbing after nearly a year of falling energy prices. Even with the increase, gas prices are still 25 percent below where they were a year ago."

Gas price problem? Blame the Saudis(???)!

Shouldn't the price be going down?

"Modest economic rebound expected; Data show winter slowdown not as bad as reported" by Christopher S. Rugaber Associated Press June 24, 2015

WASHINGTON — The US economy contracted in the first three months of the year, just not as much as previously estimated. More recent data show the weakness was largely temporary, with a rebound in the works for the April-June quarter.

PFFFFFFFFFTT!!

The economy, as measured by gross domestic product, shrank at a seasonally adjusted annual rate of 0.2 percent from January through March, the Commerce Department said Wednesday. That’s better than last month’s estimate of a 0.7 percent decrease.

They think we believe them, do they?

Harsh winter weather slowed spending by keeping consumers away from shopping malls and auto dealerships. The trade deficit ballooned, slicing growth by the most since 1985 as exports fell and imports rose.

Uh-huh. Everything is to blame except that private central bank printing pre$$, yup!

Yet consumers stepped up their spending in May, and home sales are climbing — signs the economy is back on track.

I will get to the homes later below.

In addition, many of the headwinds the economy faced in the first quarter — from an increase in the dollar’s value to spending cutbacks by oil drillers — are fading.

‘‘Growth should remain near 3 percent in the second half of the year as the dampening effects of a strong dollar and oil industry slump fade,’’ Sal Guatieri, an economist at BMO Capital Markets, said in a note to clients.

The forecasting firm Macroeconomic Advisors predicts growth will reach 2.7 percent in the second quarter. And many economists agree with Guatieri that growth will hit 3 percent in the second half of the year.

Oh, I feel so much better about the future of the economy!

Still, that would leave growth in the first half at a weak 1.2 percent annual rate. The economy appears to be on track for another year of modest 2 to 2.5 percent growth.

That’s far less optimistic than at the beginning of the year, when low oil prices and healthy hiring led many economists to forecast growth above 3 percent. The economy hasn’t reached that level in a decade.

Exports were hammered in the first quarter by a sharp rise in the dollar’s value, which makes US goods more expensive overseas. The dollar has strengthened 15 percent in the past year, compared with a basket of other currencies.

The strong dollar also makes imports cheaper and better able to compete with US-made goods. Imports increased 7.1 percent in the first quarter, while exports fell 5.9 percent. That widened the trade gap, cutting nearly 1.9 percentage points from growth, the most in 30 years.

The dollar’s value has leveled off since March.

Blah, blah, blah.

Oil and gas companies, meanwhile, sharply cut back on drilling and exploration and spent much less on steel pipe and other equipment. Business investment in structures, including oil wells, dropped nearly 19 percent, the most in four years. Those cutbacks occurred after last year’s steep drop in oil prices, but have since slowed.

Didn't hurt employment or the economy though, nope!

Americans saved more in the first quarter, aided by lower gas prices and greater hiring. The saving rate rose to 5.4 percent from 4.7 percent in the fourth quarter, the highest in more than two years.

I'm sorry, folks, I can't read this insulting shot anymore. I don't care what liars they figure.

Consumer spending growth slipped to just 2.1 percent, down from 4.4 percent in the final three months of 2014.

But since then, there have been signs Americans are opening their wallets. That should provide a crucial boost to growth. Consumer spending accounts for 70 percent of economic activity.

‘‘The slowing in consumer spending looks more like a pause that refreshes . . . rather than the start of a weakening trend,’’ Guatieri said.

Sales at retail stores and restaurants jumped 1.2 percent in May.

Auto sales jumped to the highest level in nearly a decade.

Sales of existing homes are on track for their best year since 2007. Sales of new homes last month reached their highest level since February 2008.

Employers have added 3.1 million jobs in the past 12 months, lowering the US unemployment rate to 5.5 percent from 6.3 percent.

Yeah, whatever.

--more--"

Related:

"US consumer spending surged in May with the biggest monthly increase in nearly six years — a sign of stronger economic growth ahead. The Commerce Department said consumer spending rose 0.9 percent last month, up from a revised 0.1 percent increase in April. May registered the biggest gain since August 2009, an indication the positive impacts from the solid pace of hiring and cheaper gasoline are starting to ripple through the economy. Personal income also increased a healthy 0.5 percent. The savings rate for after-tax income fell slightly, to 5.1 percent from 5.4 percent."

Now, about that wonderful, wonderful job market:

"Percentage of those in labor pool at 38-year low; That lowers jobless rate but stirs growth worries" by Megan Woolhouse Globe Staff July 03, 2015

The percentage of Americans in the labor pool fell to a 38-year low in June, a decline driven by retiring baby boomers that could make it tougher for employers to eventually find workers, potentially slowing economic growth.

Related:

"Although it ticked higher to 62.8 percent last month, the labor participation rate has been stuck for years near multidecade lows."

And now it has dropped again?

Less than 63 percent of working-age Americans had a job or were actively seeking one, the lowest participation rate since October 1977, the US Department of Labor reported Thursday. The US labor force declined by 430,000 workers last month, including retirees and others who stopped looking for work.

But don't let that spoil the corporate $will of a narrative.

“The population is getting older and more people as a result are retiring,” said Richard W. Johnson, a senior fellow and the director of retirement policy at the Urban Institute in Washington. “That’s despite the fact that people are also working longer into life than they used to.”

Look at the damn double-talk! People are retiring more, but also working longer.

The shrinking labor force contributed to a decline in the overall unemployment rate, which fell to 5.3 percent last month from 5.5 percent in May, reaching the lowest level in seven years.

Yeah, government was crowing about that "good news!"

What a bunch of deceptive bastards, huh?

In a separate survey, employers said they added 223,000 jobs their payrolls in June, the 57th consecutive month of job growth nationally.

Whatever.

The job gains were largely in line with economists forecast and strong enough, analysts said, to keep the Federal Reserve on track to raise its key short-term interest rate in September. The Fed has held that rate near zero since the end of 2008, when the US economy was plunging into recession.

Oh, that is what all the lying and fudging is about. So the bank can raise rates before it implodes.

So they finally hit the lottery, huh?

Stocks fell modestly Thursday following the report. The Dow Jones industrial average fell 27.80 to 17,730.11. The broader Standard & Poor’s 500 index ended flat, at 2,076.78. The yield on the 10-year US Treasury bond declined to 2.38 percent, from 2.42 percent Wednesday.

I no longer care about the ups-and-downs of the selective and rigged stock market.

In addition to retirements, economists said, a variety of factors contributed to the decline in labor force participation. They included a rise in the number of educated women choosing to stay at home with their children, instead of taking a job, and increases in the number of people who are receiving disability benefits.

Are you believing any of this bull$h**?

About 66 percent of working-age Americans were participating in the labor force before the last recession began at the end of 2007. The slide began during the downturn and continued during the weak recovery that followed. Economists had expected labor participation to increase as the economy improved, but it has remained low.

You know, when they contradict what they said a few paragraphs ago.... (blog editor just caught whiff of wafting smell of sh**)

“The decline is indeed a concern,” said Sara Johnson, senior research director at IHS Global Insight, a Lexington forecasting firm. “With fewer people choosing to participate in the workforce and be available for employment, we will see less growth and less income.”

That's because there are NOT ENOUGH JOBS!

Economists attributed the continued decline to demographic shifts. Prime working-age people, between the ages of 25 and 54, are sandwiched between two giant populations of workers — baby boomers born between 1946 and 1964 who have entered retirement years, and millennials, born as late as 2004 but still in school and not part of the workforce.

That is so strange because I was told millennials are making money and seniors are on the rebound.

So WTF is with the mixed me$$ages, Globe?

Johnson, of the Urban Institute, said that as more millennials enter the labor force, the participation rate will climb. In the interim, however, employers could face challenges finding workers. Companies will have to offer incentives to keep older workers longer, including better pay or more-flexible hours, he said.

Un-flipping-real! They have taken a LABOR GLUT and turned it into a LABOR SHORTAGE!!!!

New England’s economy is challenged by the demographic trend because many industries in the state have benefitted from a large pool of highly skilled, well-educated workers who are retiring or are on the verge of retirement. The Massachusetts unemployment rate, 4.6 percent, is at prerecession levels.

So I'm told.

State labor department officials will release the June statistics in about two weeks.

The New England Economic Partnership, a group of regional and academic economists, has forecast that the number of workers retiring in Massachusetts will be about the same as the number of new workers entering the workforce by 2018, potentially leading to labor shortages and weaker economic growth.

Look, they are already laying the groundwork for failure.

The forecast projected that Massachusetts will add 50,000 to 60,000 jobs a year through 2016, before slowing to about 40,000 in 2017 and plunging to about 14,000 in 2018.

Employment growth will decline not because companies don’t have jobs, but because they won’t be able to find enough workers, according to the forecast.

“Size matters,” the forecast said. “If the labor force shrinks below a critical level and employers cannot find the talent they want, businesses could move to other regions, starting a downward spiral of investment and jobs.”

OMG!!!!!!!

--more--"

Yeah, good thing the state economy is great!

"Mass. economy outpacing US, but challenges still exist; Region still faces challenges such as high energy costs" by Jay Fitzgerald Globe Correspondent June 02, 2015

Brutal winter? What brutal winter?

The Massachusetts economy has brushed aside the record snowfall that hobbled businesses earlier this year to post impressive gains in employment, wages, and consumer spending, outpacing the nation as a whole.

And the state’s economic growth is expected to accelerate, according to a report by the New England Economic Partnership, a nonprofit group of regional economic researchers.

Massachusetts, however, still faces a number of critical challenges — including high youth unemployment and rising costs for energy and housing — but the general economic outlook is bright, the report says.

“The Massachusetts economy is humming, performing at or better than expected,” the report says. “The harsh weather in January and February was no more than a speed bump in the state’s economic growth, which is bouncing back robustly this quarter.”

Driving the growth are the state’s technology, biotechnology, and health care sectors, which have expanded solidly in recent years, said Alan Clayton-Matthews, a Northeastern University economist and author of the report.

In addition, companies in another key sector, financial services, are hiring again, after several difficult years following the last recession and 2008 financial crisis.

Statistically, the state’s economy performed better this past winter than it did the previous winter, growing at a nearly 1 percent annual rate in the first three months of the year, compared to shrinking 2.1 percent in 2014. That first-quarter growth easily outpaced the US economy, which shrank nearly 1 percent during 2015’s first three months, weighed down by weak consumer spending, a stronger dollar that hurt exports, and labor disputes at West Coast ports that disrupted trade. Severe winter weather in many parts of the country also hampered growth.

Blah, blah, blah.

The state’s winter performance comes as somewhat of a surprise, the report said, considering that a series of snowstorms in January and February brought the region to a standstill, shutting down roads, transit systems, and many businesses.

I was thinking of another word, but....

“All of that was temporary,” said Clayton-Matthews.

OMG!

The report forecasts a strong rebound, with the economy projected to grow by a 6 percent annual rate in the second quarter and 5.5 percent in the third quarter, based on the analysis of jobs, state tax collections, and other economic data.

In the 12 months ended in April, the state added 66,000 jobs, while the unemployment rate fell more than a percentage point, to 4.7 percent, well below the national average of 5.4 percent.

They fudge it like the feds?

Wage and salary growth has also been impressive, boosted by the concentration of high-paying industries such as technology, biotech, and health care, and by a tightening labor market.

In the last half of 2014, wages and salaries in Massachusetts grew at about a 10 percent annual rate, double the national rate, according to the report. In the beginning of 2015, wages and salaries grew at about a 5 percent annual rate, in Massachusetts and nationally.

That wage growth has helped support stronger consumer spending here, according to the report. While consumer spending was essentially flat nationally in the first three months of the year, it grew at a nearly 2 percent rate in Massachusetts.

John Murtha, general manager at the 551-room Omni Parker House in Boston, said business has picked up in his industry since the recession. But it’s now getting more difficult to fill positions as the jobless rate falls.

The hotel has six to eight positions it’s trying to fill, from room attendants to lobby supervisors.

“We would have filled those positions by now two years ago,” he said. “The labor market is getting a little tighter.”

Despite the improvement in the economy, the state still faces challenges.

Of particular concern is the high unemployment rate for workers 25 and younger, which is still above prerecession levels, according to labor statistics.

Of course, we were told millennials are rolling in dough.

Also, the number of people in Massachusetts who are working part-time jobs because they can’t find full-time positions is 2.3 times higher than it was in 2007.

“The overall job statistics can mask what’s really happening,” said Elliot Winer, an economist at Northeast Economic Analysis Group in Sudbury. “There’s still some questions about the caliber of the type of jobs being created.”

Do I really have to type anything anymore?

The region’s high energy prices — particularly for electricity, now running 40 percent higher than the national average — are acting as a competitive drag on the economy, the report warned.

Turns out you got gouged because the higher wholesale prices never happened.

It found that Massachusetts residents and businesses pay more for all forms of energy, including gasoline and natural gas, than their counterparts nationally.

Another challenge: the state’s high housing costs, particularly in the Boston area.

WHAT?

Jeffrey Gates, co-owner of Acquitaine Group, owner of eight restaurants in the area, said the high housing costs are making it difficult to attract and retain employees.

“It’s very concerning,” Gates said of housing prices and the tight labor market.

That's odd because the Globe has told me that is good.

“I’m very troubled by it. We need all these people closer to where they work — not just for the labor force but for the very fabric of our society. Housing isn’t affordable for many people, and I believe that’s harming the entire economy.”

Ended on a bad note?! WTF?!!!!!!

--more--"

Related: Massachusetts Economy Mirrors Brazil

And what do you $ee when you look in the mirror?

"Businesses’ confidence in the Massachusetts economy slipped in May, but many plan to keep hiring and increasing pay slightly. According to Associated Industries of Massachusetts’ monthly survey, business confidence fell 1.8 points to 57.3 on a 100-point scale. The index had hit a 10-year high in March, at 60.2. The trade group’s separate employment index, which gauges hiring plans, hit a 10-year high this month, however. “Our survey does reflect lower expectations for the six months ahead,” Raymond Torto, an AIM economist, wrote in a blog post. “We also see lagging confidence among manufacturers, whose exports are hurt by the strong dollar, and among mid-size companies.”

Flies right in the face of the Globe report.

After a while it's clear they are giving you nothing but bulls*** for bu$ine$$ news.

As for the rest of the region:

"In New England, N.H., Mass. lead growth; 2.3% gain in 2014 is slightly better than US economy’s rate" by Jack Newsham Globe Correspondent June 10, 2015

The Massachusetts economy grew 2.3 percent last year, tied for fastest in New England and slightly greater than the country as a whole, according to new data.

On Wednesday, the Commerce Department reported that Massachusetts ranked 15th among the 50 states in terms of economic growth last year.

North Dakota, in the midst of an oil boom, had the fastest-growing state economy, surging by more 6 percent — nearly triple the US growth rate of 2.2 percent.

Massachusetts nearly doubled its 2013 economic growth rate of 1.2 percent. In the Northeast, only New York’s economy, which expanded 2.5 percent last year, grew faster than Massachusetts’.

In New England, New Hampshire’s economy grew 2.3 percent; Rhode Island’s, 1.2 percent; Connecticut’s and Vermont’s, 0.6 percent each; and Maine’s, 0.2 percent.

Since the end of the last recession six years ago, Massachusetts has benefited from its strong technology and life sciences industries, which have added jobs, paid high wages, and attracted billions of dollars in investment.

**********

Shu Deng, a economist for Moody’s Analytics in West Chester, Pa., added that more people are not only entering the states’ labor force to look for work — a sign of improving prospects in the job market — but they are also finding it.

The state’s unemployment rate has fallen more than a percentage point over the past year.

Deng said the state’s labor force is growing at rates not seen since 2000, around the time of the peak of the dot-com boom.

OMG!! Deng dung.

Deng noted that those new workers are consumers too, spending money on goods and services and supporting the businesses that provide them.

They are also increasing the demand for housing, raising sales prices and spurring developers to build more — as well as to hire more workers, Deng said.

Construction companies added about 4,000 jobs in 2014, an increase of approximately 3 percent, according to state statistics.

Real estate investors “are going to become more optimistic, so they’ll add a supply of houses to the market,” she said.

“That’s definitely beneficial,” Deng added.

--more--"

Related:

"Six years after the recession ended, workers in most occupations in New England have yet to regain the buying power they had before the historic downturn began at the end of 2007. Weekly earnings last year, in fields from food preparation to management, were below 2007 levels when adjusted for inflation, according to an analysis of Labor Department and Census Bureau data by the Center for Labor Market Studies at Drexel University in Philadelphia. Of the 22 occupations tracked by the Labor Department, 17 did not reach prerecession pay levels. Meanwhile, unemployment rates in most occupations in New England remain above the 2007 levels. Despite the improving economy, the data underscore that many working families have yet to fully recover."

Not in Massachusetts, I was told.

At least it is the best job market in years, millennials are making economic gains, seniors are a post-recession success story, and the slow motion economic recovery is paying off if you can afford stocks.

"Tightening labor market tilts in Mass. workers’ favor; As unemployment rate falls, pay and opportunity rising" by Megan Woolhouse Globe Staff June 08, 2015

Yeah, labor participation is at its lowest in decades, and yet.... SIGH!

The balance of power between employee and employer is shifting, with workers in Massachusetts increasingly able to bargain for higher pay, find new jobs quickly, and even choose between competing offers.

If the Globe says it, it must be true!

Employers — from tech firms to manufacturers to restaurants — say they are having a harder time finding people to hire as the state’s unemployment rate, 4.7 percent in April, approaches the prerecession low of 4.6 percent. As a result, more and more workers are gaining leverage in getting the jobs, and the wages, they want.

“It’s one of the strongest jobs market in a generation,” said Andrew Chamberlain, an economist at Glassdoor, a California recruiting company. “Job seekers should be taking advantage of it.”

Of the 50 largest American cities, Boston ranked sixth in number of job openings per capita, said Chamberlain. There were more than 1,200 help-wanted listings for software engineers in Greater Boston, 1,000 postings for retail sales workers, and 600 openings for store managers in mid-May. Employers posted hundreds more openings for consultants, business analysts, and customer service representatives.

“It’s one of the leading economies in the country,” said Mark Zandi, chief economist of Moody’s Analytics, a research unit of the ratings agency Moody’s Corp.

*************

These and thousands of other openings across Massachusetts are the product of a strong state economy that has created 66,000 jobs during the past year and lowered the state unemployment rate by more than a percentage point. In the first quarter of 2015, wage and salaries in Greater Boston jumped nearly 4 percent from a year earlier, the greatest gain among the nation’s biggest metropolitan areas, according to the US Labor Department.

Yeah, everything is great here.

The supply of labor here is expected to get tighter as baby boomers retire.

Who can afford to retire?

By 2017, the state’s employment growth is expected to stall, not because employers will not have jobs, but because there will not be enough workers to fill them all, according to a recent forecast by the New England Economic Partnership, a nonprofit group of business and academic economists.

The tightening job market means that workers in some fields find themselves in the middle of bidding wars for their services.

Phil Gardiner, a business and technology coach from Texas, waded into the job market cautiously while still employed at AT&T, just to see what was out there.

A lot, it turned out.

Gardiner, who holds an associate’s degree, said he was barraged with offers and counteroffers before taking a job with a Waltham staffing agency that is paying him $200,000, including bonuses — a 50 percent raise from his old job. The Waltham firm is also paying the airfare for his weekly commutes to and from his home in Dallas, where he lives with his wife and daughter.

“I love what I do so much I never really looked for a job,” said Gardiner, 46. “But I thought, ‘Wow, the money is really good.’ ”

Since the end of the recession, the state’s economy, driven by its technology, biotechnology, and health care sectors, has generally recovered and expanded faster than the nation’s. The state unemployment rate in April, the most recent one reported, was well below the national average of 5.4 percent; the state’s average jobless rate in the first quarter of the year was the 15th lowest in the nation, according to Labor Department statistics. Hourly wages in the state rose about 3 percent during the past year, compared with about 2 percent nationally.

The improving jobs front, however, has not benefitted residents equally.

What?

For example, the average unemployment rate among nonwhite minorities and Hispanics for the year ended in April was 9.3 percent, more than double the 4.3 percent average rate for whites.

Look at the bu$ine$$ pre$$ dividing us.

In addition, people who have given up job searches, meaning that they are no longer counted as unemployed, or who work part time because they cannot find full-time jobs, number about 150,000 — double the number before the recession, said Alan Clayton-Matthews, an economics professor at Northeastern University.

Then the recession never ended for a whole pile of us, and the “story for the Massachusetts economy, if you ignore high levels of unemployment and inequality, is the economy has been performing very well,” so there!

But the benefits of the state’s improving economy are starting to spread, Clayton-Matthews said.

!!!!!!!

As high-paying industries such as technology, life sciences, and financial services add workers, income in the state is rising, fueling consumer spending and the demand for goods and services, Clayton-Matthews said. That, in turn, is creating retail and service jobs for lower-skilled workers.

Oh, pi$$ on, 'er, trickle down works, huh?

Major retailers are raising wages here and across the country to attract and retain workers. In Massachusetts, for example, Walmart is paying an average wage of about $14 an hour, about $5 above the state’s minimum wage.

Gone are the days of 2009, the depths of the last recession, when applicants formed long lines outside his restaurants whenever there were openings, said Kevin Harron, president and partner at Burtons, an Andover-based chain with 11 restaurants. He said he is having problems fully staffing restaurants with servers and hosts, requiring him to ask employees to work extra hours at overtime rates.

Harron said he often drives along Route 1 in Saugus and sees “Help Wanted” signs, one after another, in front of other restaurants and businesses.

“It’s a highly competitive [labor] market,” he said.

Good pay, is it?

Manufacturers know that feeling. At a recent meeting of the Massachusetts Manufacturing Extension Partnership, a Worcester nonprofit that runs programs to sustain manufacturing, more than a dozen employers complained about labor shortages in the industry and grilled state officials about how the companies could get more trained workers faster.

H1-Bs and illegals.

Paula E.F. Martel, human resources manager at North Easton Machine Co., a fourth-generation machine shop with 25 employees, said she has struggled for nearly six months to fill two positions, for an engineer and a machinist, despite increasing the pay to attract more candidates.

She said the company, which is growing as many US manufacturers move production back from overseas, would probably hire more people if it could find the workers.

The shortage has become so acute, she said, that companies often poach each other’s employees by offering better pay, benefits, or hours.

“It’s gotten a bit more cutthroat,” she said. “If you have an opening, it’s like all bets are off.”

Yeah, someone is bleeding us all, all right.

--more--"

I'm going to stay faithful to the propaganda.

"Mass. jobless rate drops to pre recession level; Employers add 7,400 new jobs in May" by Karishma Mehrotra Globe Correspondent June 18, 2015

The jobs picture keeps getting brighter in the Bay State....

“Another month, another good employment report,” said Alan Clayton-Matthews, a Northeastern University economics professor. “This state is growing robustly.”

The jobs data marked another milestone for Massachusetts, which has generally recovered from the recession faster than the nation as a whole, led by the technology, biotechnology, and health care sectors.

They lied to you the last time they said that, why would now be any different?

The falling unemployment rate — it’s now at about half the recession peak of 8.8 percent — is shifting the balance of power to workers, who are increasingly able to find new jobs quickly, choose between offers, and bargain for higher pay.

This is disgusting!

In the first quarter of 2015, wages and salaries in Greater Boston surged by nearly 4 percent from a year earlier, the biggest gain in the nation for large metropolitan regions, according to the US Department of Labor.

Nationally, job and wage growth have been spotty in the first half of the year.

You can read the Andrew Balow success story if you want!

***************

Unemployment in the state is still well above the levels during the last tech boom, when the jobless rate fell to 2.6 percent in May 2000. But Clayton-Matthews said the benefits of this expansion are spreading beyond the technology and health care sectors as the economy enters what analysts call a “virtuous circle,” in which more jobs lead to rising income, which spurs more spending, which leads to higher demand for products and services, and ultimately more jobs.

Well, there are way more people looking for work since then, thus not enough jobs, but don't let that spoil this crap narrative as they pimp supply-side economics!

Retail employment, for example, jumped by 1,500 jobs in May, the state reported. Construction companies, riding a commercial building boom, added 3,500 jobs, the biggest monthly gain in more than 15 years. Manufacturing added 600 jobs last month, financial activities added 700 jobs, and education and health services gained 500 jobs.

Education and health services, which includes universities and hospitals, added nearly 20,000 jobs during the past year, according to the state. Another key sector, professional and business services, which includes technology, scientific research, and consulting firms, added more than 18,000 jobs in the past year.

So the lying, $elf-$erving state says.

“This speaks to a steady and consistent pattern of economic growth, which is what you really want to see,” said Chris Geehern, executive vice president at Associated Industries of Massachusetts, the state’s largest employers group.

Many companies, however, remain wary of expanding too rapidly, analysts said, keeping their eyes on developments that could upset the global and US economies, such as a default by Greece on its debt or a significant slowdown in China’s economy.

“Employers remain cautious,” Geehern said. “They don’t want to go out and hire 25 new people without clear confidence that the growth of their company is going to justify that.”

While the labor market is broadly improving, workers with less than a high school diploma are still experiencing high unemployment, said Michael Goodman, executive director of the Public Policy Center at the University of Massachusetts Dartmouth.

Many long-term unemployed are still struggling to find work.

“We have to temper the good news with the recognition that this rising tide has not been lifting all boats,” Goodman said.

Arrrrrrrggggggghhhhhh!!!!!!!!

--more--"

Related:

"The confidence levels of Massachusetts businesses dropped for a third straight month in June, but business leaders remained optimistic overall, according to a trade group. Earlier this week, Associated Industries of Massachusetts said that employer confidence dropped from 57.3 in May to 56.3 in June. Readings above 50 indicate positive feelings about the overall economy, while those below 50 suggest pessimism."

How can that be when this state economy is roaring and exports are up 5 percent?

If anyone should be confident, it's should be Massachusetts business leaders.

Maybe you just need to work harder, you lazy sh**s.

Time to head home -- if you are lucky enough to have one:

"Homeownership rates fall across state, US; Rising costs, weak incomes, loan rules blamed for decline" by Jay Fitzgerald Globe Correspondent June 24, 2015

The American Dream of home ownership is slipping away for an increasing number of people.

The percentage of US households owning their homes slid last year to 64.5 percent, the eighth consecutive year of declines and the lowest level in two decades, according to a report released Wednesday by the Joint Center for Housing Studies at Harvard University.

In Greater Boston, the ownership rate is even lower: 60.9 percent, down from 64.2 percent prior to the recession, according to the latest data.

The culprits for the homeownership decline are easy to identify: rising home prices, stagnant incomes, tougher lending standards, and a lack of housing construction to meet demand, the report said.

And yet I have been told the housing market is fine, rising prices is good

These same trends are driving up demand for rental housing and pushing rents higher — rising nationally at about double the rate of inflation, according to the report.

As middle-class people are driven to rent after being fraudulently foreclosed upon.

In Massachusetts, the rising cost of rent is particularly acute for lower- and moderate-income households. More than two-thirds of Massachusetts households earning $30,000 to $45,000 a year spend 30 percent or more of their incomes on rent, compared to less than half nationally, according to the report. One in three households earning $45,000 to $75,000 here devote more than 30 percent of their income to rent, compared to one in five nationally.

Lack of homes reignites bidding wars

That is how they are keeping real estate prices high, because if they fall the stock market craps out.

Across US, renters are on the rise

Suburban housing market rebounds

Whatever, Globe?

That is how they are keeping real estate prices high, because if they fall the stock market craps out.

Across US, renters are on the rise

Suburban housing market rebounds

Whatever, Globe?

“They’re getting squeezed,” said Chris Herbert, managing director of Harvard’s Joint Center for Housing Studies. “More or less, this squeeze is happening across the country.”

The center, using data from the US census, assesses the nation’s housing markets each year. Homeownership rose steadily during the 1990s, peaking at about 69 percent of US households in 2004. But homeownership began to slide when the last housing boom turned to bust shortly after that.

“This erases nearly all of the increase from the previous two decades,” Herbert said, “and the trend does not appear to be abating.”

Indeed, an increasing number of people 45 to 64 years old — prime ages for owning a home — are jumping into the rental market, dispelling the notion that it’s mostly struggling young people frozen out of the market who are resorting to renting, the report said.

That's the crap that the propaganda pre$$ was pushing.

Millennials, those born between 1985 and 2004, are facing their own obstacles to homeownership, particularly high student loan debt, the report notes.

PFFFT!

In Boston, the hurdles may be a bit higher. The city’s housing costs rank in the top 10 among metropolitan areas, according to the study. The median home price in the Boston metro area, about $390,000 in 2014, was nearly double the national median of $209,000, according to the National Association of Realtors.

The median home price in Greater Boston is more than five times the median income, compared with less than four times nationally, according to the Harvard report.

But some positive trends are underway, the report noted. Fewer home foreclosures are taking place across the nation.

That's a lie, too!

Remember, this state's economy is doing better than most -- and yet foreclosures are on the rise.

Home construction starts have increased in recent years, rising to just over 1 million last year from 554,000 in 2009, during the depths of the recent recession. But new construction still lags the peak of 2 million housing starts in 2005, the report said....

Home builders mostly blame restrictive zoning regulations in many municipalities for the lack of construction in Massachusetts.

The Harvard report noted that the historically low construction levels here and nationally are contributing to low inventories of homes for sale.

HUH?

The Globe is always crowing about construction in Boston's hot office and real estate market!

--more--"

"Tight supply saps home, condo sales" by Karishma Mehrotra Globe Correspondent June 23, 2015

Massachusetts home sales fell in May, compared to the same month last year, as a tight supply of properties on the market continued to frustrate buyers, according to analysts and industry officials.

Sales of single-family homes dropped nearly 3 percent in May, the third year-over-year decline in the past five months, the Warren Group, a Boston real estate tracking firm, reported Tuesday.

Condominium sales fell nearly 6 percent from May 2014, the seventh consecutive month of declines compared with a year earlier, according to the Warren Group.

“There just aren’t that many homes for sale,” said Timothy M. Warren Jr., chief executive of the firm. “There are a lot of eager buyers who find two things: lack of choice and more competition.”

Real estate agents and analysts have blamed a lack of homes on the market for lackluster sales over the past several months and for the bidding wars over available properties that have broken out in many communities.

************

Corinne Fitzgerald, president of the Massachusetts Association of Realtors, said, “There is no question. We need to be able to build more homes.”

Home prices have mostly climbed in recent months, although the state median remains below the prerecession peak.

The median single-family home price, $340,000 in May, was unchanged from a year earlier, according to the Warren Group. The median condo price rose 2.2 percent to $327,000 from $320,000 in May 2014.

The spring selling season, which real estate agents say generally runs from March to July, got off to a slow start this year following a winter of record snow.

Sigh.

Fitzgerald said that new listings have increased recently, while the improved economy and low mortgage rates should continue to lure buyers.

Barry Bluestone, an economist and director of Northeastern University’s Dukakis Center for Urban and Regional Policy, said the disappointing sales of recent months may prove temporary as demographic changes over the longer term spur increased activity. Aging baby boomers will continue to downsize to smaller quarters over the next few years, while younger families will seek single-family homes.

“I don’t think these [current housing] numbers represent the future,” he said. “The more important story is what will occur in the next three to five years.”

UNREAL!

--more--"

So where are you staying tonight?

Here is something to read before going to sleep:

"10 Very Strange Things That Have Happened In Just The Past Few Weeks" by Michael Snyder, on July 8th, 2015

Have you noticed that events have begun to accelerate? Over the past few weeks, things have officially started to get very weird. Chinese stocks are crashing, the Greek debt crisis is spiraling out of control, the New York Stock Exchange was down for about four hours on Wednesday thanks to a “technical glitch”, and global politicians have been acting very strangely. After several years of relative calm, could it be possible that the second half of 2015 will usher in a time of chaos and confusion on a worldwide scale? Personally, I have never been more concerned about a period of time as I am about the last six months of 2015. And if I am right, what we have seen so far is just the tip of the iceberg. The following are 10 very strange things that have happened in just the past few weeks…

#1 On Wednesday, the New York Stock Exchange, United Airlines and the Wall Street Journal were all taken down by unexpected “technical glitches“. Authorities are assuring us that hackers were not responsible for any of this.

#2 In China, a full-blown stock market crash is unfolding. The Shanghai Composite Index has plummeted more than 30 percent in less than a month, and the Chinese version of the NASDAQ has dropped by more than 40 percent. The amount of “paper wealth” that has been lost in China is 15 times greater than the GDP of Greece.

#3 Just the other day, hackers were able to hack into a German surface-to-air missile battery…

Well, this is absolutely terrifying. According to The Local, hackers attacked a German Patriot surface-to-air missile battery, like the one shown above, stationed along the Turkish-Syria border. The cyber attack caused the battery to carryout “unexplained” orders.

It’s believed that cyber attackers managed to exploit the Patriot battery in two different ways. The first exploit was through the Sensor-Shooter-Interoperability, which controls interactions between the actual, physical missile launcher and its control system, while the other was on the guidance chip. These weaknesses could have allowed the hackers to steal data or, more worryingly, actually take control of the battery.#4 Earlier this week, Barack Obama told reports that “we’re speeding up training of ISIL forces“…

#5 Just a few days ago, the U.S. Mint announced that they were sold out of American Eagle silver coins on the exact same day that the price of silver hit a new low for 2015. How does that make any sense?

#6 On June 30th, an unexpected blood moon was seen over a significant portion of the United States. The following is an excerpt from a recent article by Caiden Cowger…

On June 30, 2015, a surprise blood moon appeared in the sky, that was only seen in the United States.

According to the National Weather Service, large wildfires in Canada have been burning. Due to extremely high winds, smoke from these fires have traveled into the United States.

According to NBC-Chattanooga, “the smoke should remain in the higher atmosphere and not affect air quality, it gives the moon and sun a rosy glow.

Here’s what causes the effect:

As light from the moon or sun enters the atmosphere it gets scattered by particles like water, aerosols, and in this case smoke. Green, blue, and purple colors are sent in all directions but colors with longer wavelengths like red, orange and yellow continue through the atmosphere and remain visible to the human eye.”#7 Even though NASA recently stated that they know of “no asteroid or comet currently on a collision course with Earth” and that “no large object is likely to strike the Earth any time in the next several hundred years“, NASA has teamed up with the National Nuclear Security Administration to try to figure out a way to use nuclear weapons to destroy asteroids that are threatening our planet. If there is no threat, why spend so much time and energy on this?

#8 A couple of weeks ago, we learned that Barack Obama has issued 19 “secret directives“. What is Obama planning, and why won’t he let the general public know about it?

#9 This week, Pope Francis called for the creation of “a new economic and ecological world order where the goods of the Earth are shared by everyone, not just exploited by the rich.” So exactly what would such a “world order” look like?

#10 The Greek people just overwhelmingly voted to reject austerity, so EU officials have responded by giving the Greek government a one week deadline to come to an agreement that will include even more austerity for the Greek people. If the Greek government does not submit, EU officials are threatening them with bankruptcy, the collapse of their banking system and expulsion from the euro.

Things promise to only get stranger from here. One week from today, on July 15th, a massive military exercise known as “Jade Helm” begins. More than 1,000 members of the U.S. military will be taking part in drills that will be conducted in the states of Texas, Colorado, New Mexico, Arizona, Nevada, Utah, California, Mississippi and Florida.

Then in September comes the end of the Shemitah year, the fourth blood moon of this tetrad, the launch of a radical new sustainable development agenda at the United Nations that is being endorsed by the Pope, and a vote on a UN Security Council resolution that would formally establish a Palestinian state.

And that is just the stuff that we know about.

So what do you think we should expect from the rest of this year?

--MORE--"